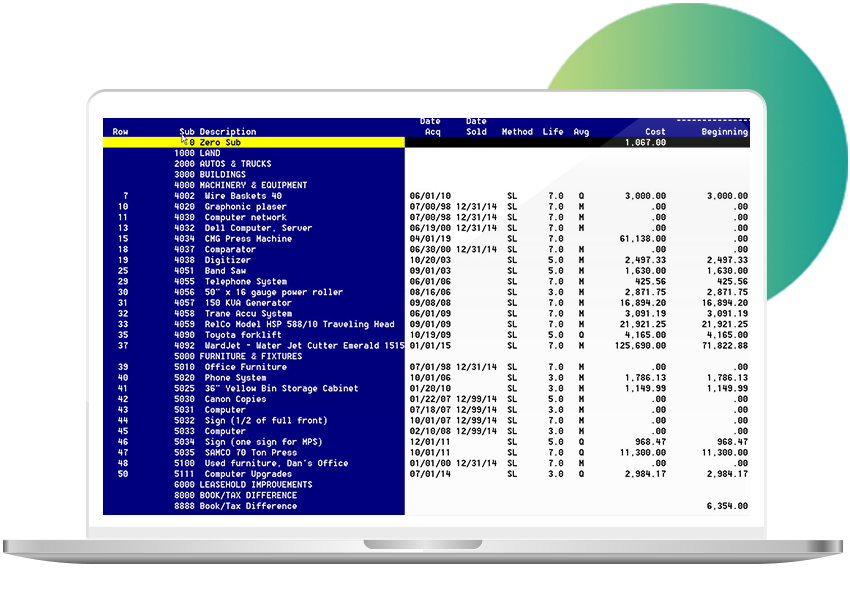

Plus & Minus is a powerful Fixed Asset analyzer if fixed assets are set up properly. It calculates depreciation using most of the common methods for financial and tax reporting purposes. The depreciation worksheet collects existing account balances, calculates depreciation, disposes of assets, and generates entries to agree your financial statement to the worksheet. Depreciation can be generated for a month, quarter, or year.

Methods

- Straight line

- Same amount for each year

- Declining balance

- 150% with flip to straight line

- Double declining balance

- 200% with flip to straight line

- Sum of years digits

- Defined

- MACRS (Modified Asset Cost Recovery System)

- Title (to generate subtotals)

Lives can be from 0.1 to 99.9 years.

How it works

The depreciation worksheet generates a worksheet using the fixed asset sub accounts. It calculates cost and accumulated depreciation balances using the range dates you enter. You calculate depreciation using Calc, with the information in the deprecation worksheet, and you can record the worksheet after reviewing it. The difference between accumulated depreciation and calculated depreciation is “squeezed” to depreciation expense using the expense gen/sub for each asset.